Opportunities for the high tech suppliers in the Indian Electric Vehicles Market

With evolution of over a century, automobile sector is now looking forward to a giant leap; a giant leap towards becoming sustainable, smart and clean. Consumers and major car makers have already taken their first step in this direction. Needless to mention, evolution of Electric Vehicles is the leap we are talking about.

In India, strong government push for vehicle electrification and correct steps in the direction of building required infra have set the ball rolling and EVs have become a driving factor for most of the major car makers.

In this article, we will examine the EV scenario in India. We will focus on what are different factors that will drive the growth of electrification of vehicles in India and what are the opportunities in Indian EV market for technology suppliers.

Thinking Big – Government’s Vision

India is one of the largest auto markets globally. In such markets, making huge shifts is possible only through guidelines, incentives and active support from the government. In India, the government think tanks are playing the major role in shaping electric mobility.

Strong Roadmap for vehicle electrification :

NITI AAYOG, a government think tank has laid out aggressive road map for EV adoption.

As per the guidelines issued by this think tank,

•2023: All three-wheelers sold in India to be only electric.

•2025: All two-wheelers below 150cc sold in India to be only electric.

•2026: All new cars sold for commercial use (Uber, Ola etc.) to be only electric.

•2030: All inter-city public transport to be 100% electric including buses, three-wheelers, taxi fleets.

If one connects their road map with actual numbers, India will be producing 20 million EVs within next 6 years.

Generous incentives for expediting manufacturing :

The Indian government targets to make India one of the largest EV hubs in the world and has sanctioned USD 1.4 billion to support this over 3 years.

Under the scheme FAME-II, the government is now incentivising vehicles based on battery size and in terms of volume and plans to incentivise about 7000 electric buses (priced up to USD 278,000), 20,000 hybrid passenger cars (priced up to USD 20,800), 35,000 electric passenger cars, 500,000 electric three-wheelers (priced up to USD 7,000) and 1,000,000 electric two-wheelers (priced up to USD 2,000).

Strong emphasis on charging infrastructure :

Vehicle electrification needs to be a holistic effort. Without adequate charging infra, vehicle electrification means little. India has laid out a concrete road map for building charging infra across the country. Government has sanctioned US $ 140 Million for supporting the setting up of charging infra and plans to setup 2700 charging stations in major metros in 3 years.

As per Indian government guidelines for Charging Infrastructure :

At least one charging station in a grid of 3 Km X 3 Km in the cities.

One charging station at every 25 Km on both sides of highways.

Fast charging for heavy vehicles at every 100 Km on both sides of highways.

With this kind of thorough planning and incentivising, electrified vehicles will penetrate the markets sooner than we expect.

Opportunities for technology suppliers :

Just like the fossil fuel powered vehicles, electric vehicles have a complex supply chain of their own. When a huge market is set to embrace a change of this kind, it creates large opportunities for OEMs, Tiers 1s as well as suppliers to them. We have been studying what this transition will mean to tech suppliers to the automotive industry. Based on our research, there is massive opportunity around the corner. Here are some of the focus areas

where these opportunities await:

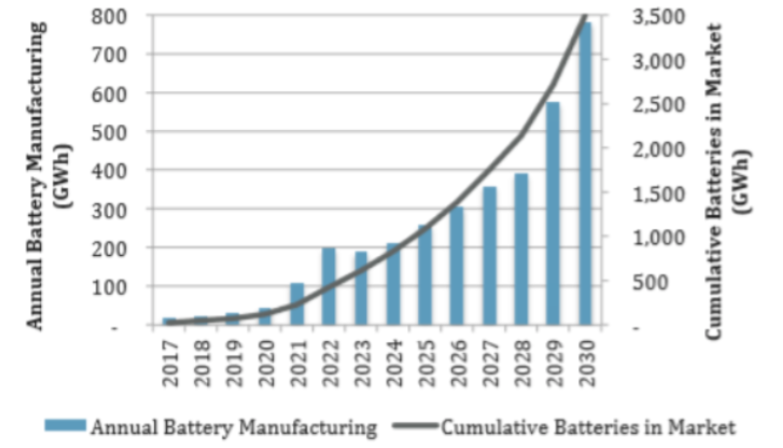

Battery pack manufacturing : One of the most important constituent in the EV supply chain is the battery pack. As per a report released by the Rocky Mountain Institute, India will have two-fifth of the global battery demand by 2027.

Needless to mention, manufacturing battery packs for EV is a technology intensive activity and will need a large number of technology suppliers like specialised welding technologies for instance.

Suppliers to charging infra providers : Creating a robust charging infrastructure will open doors of possibilities for a large number of technology suppliers. Switch manufacturers, PLC manufacturers, transformer manufacturers etc. will benefit a lot from this migration to electric vehicles. The important point to consider is, at this point, EV market is like a Greenfield project. So early adapters will enjoy huge benefits of scales in the near future.

Misc components and technologies: EVs themselves require wiring harnesses, motors, battery management systems, and a large number of other components. Electric Vehicles also need specialised technologies like battery thermal management for their safe and reliable operation. Even global suppliers for these components and technologies will find massive opportunities in the Indian market.

Post COVID-19 opportunities :

With all large countries being skeptical about the growth in the post pandemic world, experts have claimed that 2020-21 would be a defining year for the EVs in India.

According to experts at the ETAuto Virtual Roundtable on ‘Post Covid-19: Future of Electric Vehicles Global and India’, the EV market is set to recover quickly from the coronavirus impact as compared to their fuel combustion counterparts. As a result, it is expected that the EV outlook in the medium term shall remain robust. Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV) is of the opinion that the EV industry is taking shape and that despite the coronavirus outbreak, the financial year 2020-21 is going to be a defining year for all EV segments. Naturally, the EV industry is going to be affected just like any other automotive business, but Gill states that cleaner air due to reduction in pollution is leaving a permanent impression in the minds of customers, which will promote the move towards e-mobility.

According to Sarwant Singh, Managing Partner – Middle East, Africa and South Asia, Frost & Sullivan, around 15% of the vehicles in the two-wheeler industry could be electrified in the smaller segment, especially the one below 100cc. He also feels that e-rickshaws have a good business case. These sentiments are echoed by Sulajja Motwani, Founder and CEO of Kinetic Green Energy. She feels that the outlook for two-wheelers, three-wheelers and buses remains very strong in a vast market like India. She also expects that the electrification of scooters will be faster than that of motorcycles. Additionally, she asserts that the three-wheeler market shall recover the fastest and that she expects approximately 30-40% of three-wheelers in India to be electric in next 8 years, especially with the low transportation cost, e-commerce delivery coming in as well as the need for last-mile connectivity solutions.

Summary :

From the above discussion, one can easily arrive at the quantum of opportunities that Indian EV market has, especially for high-tech suppliers. In case you would like to know more about getting your tech business to India, please write to us at sudhir.nerurkar@quanzen.com